|

UnAnswered

Questions for Stanley Sporkin

#1 Why is the Sporkin fox in the Fannie Mae hen house?

Stanley Sporkin has been retained

by the Office of Federal Housing Enterprise Oversight (OFHEO) to assist

in its duties overseeing Fannie Mae -- one of the largest issuers of mortgage

backed securities and related derivatives in the world.

Why should we care? All

Americans are impacted by the health and well being of Fannie Mae's operation

- as homeowner, as investor and as taxpayers.

- The entire US mortgage market

is currently dependent on several private corporations that enjoy special

governmental credit support (called Government Sponsored Enterprises

or GSEs). Because of their size, the value of our homes may decrease

if a GSE becomes troubled.

- Many pension funds, mutual

funds and money market funds include Fannie Mae securities. Hence, the

retirement savings of many Americans and global citizens, as well as

the resources of global financial institutions, are now vested in Fannie

Mae's well being.

- If government resources

are called upon to forestall or support Fannie Mae in a bankruptcy or

reorganization, our tax dollars and taxpayer-backed government credit

could be diverted to fund Fannie Mae's liabilities and to subsidize

the US mortgage markets.

- If one GSE is troubled,

it could impact the viability and health of the others, including Freddie

Mac and the Federal Home Loan Bank System, as well as Ginnie Mae, a

governmental corporation at the Department of Housing and Urban Development

(HUD).

The following questions, organized

around Judge Sporkin's historical areas of responsibility, are intended

to illuminate the background and experience that Judge Sporkin brings

to the task of assisting the Bush Administration in the oversight and

regulation of Fannie Mae.

This information should be

useful to investors in US mortgage securities who are assessing credit

ratings and pricings of Fannie Mae, Freddie Mac, FHFB, Ginnie Mae and

other related mortgage and homebuilding stocks, bonds and derivatives

or the investment, mutual funds, pension funds and money market funds

that hold them.

These questions have been sent

to Judge Sporkin. We will post any response we receive.

|

Regulating Fannie Mae

|

FannieMae |

Question

#1: Are you under

investigation by the Department of Justice?

On November 1, 2003, the Washington Post reported that the Department

of Justice's Office of Professional Responsibility had opened an

investigation into your alleged misconduct along with a group of

attorneys at the Central Intelligence Agency (CIA)

and Department of Justice (DOJ) involved in the prosecution of a

former CIA officer, Ed Wilson. This investigation was inspired by

a ruling in the Wilson case in which the Judge ruled that government

lawyers, including you, "knowingly used false evidence"

in Mr. Wilson's trial and appeal.

Inquiry

in Case of Arms Dealer – Justice to Probe Conduct of Prosecution

Washington Post, November 1, 2003

Opinion

on Conviction; United States of America vs. Edwin Paul Wilson,

Judge's Opinion, US District Court, Southern

District of Texas, October 27, 2003

<-

Return to Table of Contents

Question

#2: What are your

potential conflicts of interest?

Are there any conflicts of interest created by DOJ's investigation

into your alleged misconduct in connection with the Wilson case,

and your role on behalf of the Administration in overseeing Fannie

Mae, given the DOJ and Securities & Exchange Commission (SEC)

investigations of Fannie Mae?

You are a partner of Weil, Gotshal & Manges,

a law firm noted for its expertise in corporate bankruptcy. Given

Weil's corporate client base –

including as lead bankruptcy counsel for Enron –

what are the potential conflicts of interest involved in

your role helping to regulate Fannie Mae,

a large private corporation? What are the potential profits of your

firm and its network of serving as a lead counsel in a Fannie Mae

bankruptcy?

The

Real Deal on Enron,

Interview with Catherine Austin Fitts by Dan Armstrong, Parts

1-7, April 2003

Enron:

Anatomy of a Cover Up,

Interview with Catherine Austin Fitts by Dennis Bernstein

<-

Return to Table of Contents

Question

#3: Does the math

of the mortgage bubble work?

How many homes are there in America? What is their appraised value?

What is the number of outstanding mortgages in America and what

is their outstanding principal value? What is the basis of allegations

that there are more mortgages outstanding in the mortgage markets

than there are homes?

What is the total value of outstanding mortgage backed securities

and tax-exempt municipal

housing bonds related to American homes and mortgages? What

is the basis of the allegations that outstanding securities

are greater in value by a significant amount than the US residential

housing stock that secures them?

What is the total principal amount of outstanding derivatives related

to these mortgages and

homes ? Does the algebra work here or something fraudulent

going on?

Does increasingly centralized control of the appraisal industry

have something to do with current valuations? Is there merit to

the allegations that the Bush Administration and Judge Sporkin are

tightening oversight of Fannie to avoid

Congressional investigations that

might unravel the continuing financing and refinancing of

sizeable mortgage securities frauds from the 1980s and 1990s?

What will happen to the value of American homes and Fannie Mae,

Freddie Mac, Federal Home

Loan Bank System and Ginnie Mae securities as a significant

number of American jobs are transferred abroad with the help and

support of U. S. government policy? What could a rise in interest

rates to do these various values? What would happen if the total

equity value of America's home net of outstanding mortgage finance

turned negative?

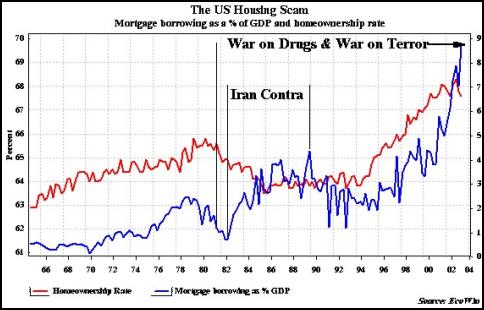

How can the US mortgage rate surpass

the homeownership rate?

(graph courtesy of global economy expert Chris Sanders

from his article "Where is the Collateral?")

Where

is the Collateral?

by Chris Sanders, October 2003

America's

Black Budget & Manipulation Of Markets

Jim Puplava interviews Catherine Austin Fitts, 18 May 2004

on Financial Sense Radio - Transcript

/ Real

Audio / MP3

The

Story of Edgewood Technology Services—or How I Lost $100Million,

by Catherine Austin Fitts, July 2002 (Parts I-III)

The

Negative Return on Investment Economy – a Discourse on America's

Black Budget,

by Chris Sanders and Catherine Austin Fitts, June 2004

The Myth of

the Rule of Law: The Destruction of Hamilton Securities,

Catherine Austin Fitts, November 2001

Piracy

on the Delaware

by Catherine Austin Fitts, 20 May 2004

Reality

Realty – Global Real Estate Markets Forum

<-

Return to Table of Contents

Question

#4: Why are Fannie

Mae and HUD still using the same auditor?

If the

Bush Administration and the Office of Federal Housing Oversight

believe that Fannie Mae's books have not been properly maintained,

why do the Department of Housing and Urban Development (HUD) and

other agencies of the US government use the same firm, KPMG, as

an auditor and contractor? If the

Bush Administration and the Office of Federal Housing Oversight

believe that Fannie Mae's books have not been properly maintained,

why do the Department of Housing and Urban Development (HUD) and

other agencies of the US government use the same firm, KPMG, as

an auditor and contractor?

<-

Return to Table of Contents

Question

#5: Is partisan

politics involved in the regulation of Fannie Mae?

Fannie Mae has traditionally been viewed as a Democratic stronghold.

The current CEO, Franklin Raines was the head of Office of Management

and Budget (OMB) during the Clinton Administration. The prior CEO,

Jim Johnson was equally involved in Democratic administrations and

campaigns.

A Washington Post report describes Fannie Mae's recent encounter

with its regulators and Judge Sporkin as follows:

"As Washington donnybrooks go, it doesn't

get any bigger than this.

The company, housing lender Fannie Mae, is the biggest in the

region, with nearly $1 trillion in assets and gobs of outstanding

debt held by pension funds and banks and even foreign central

banks, all of which crave its implicit U.S. government guarantee.

Its executive suite and board of directors are packed with the

politically well connected, while its lobbying muscle is so formidable

it has been able to fend off a concerted effort to rein in its

growth and profitability by the White House, the Federal Reserve

and the Republican leadership on Capitol Hill.

But now Fannie is reeling. A stinging report

issued by its once-obscure regulator, the Office of Federal Housing

Enterprise Oversight, alleged that top Fannie executives manipulated

accounts to inflate and smooth earnings in an effort to boost

the stock price and earn big bonuses. The regulator accuses the

company of having lax internal controls and insufficient capital

to back up its massive financial risk-taking, while ignoring the

warning of a whistle-blowing employee no longer on the payroll.

The report, prepared by Deloitte & Touche and Stanley Sporkin,

a longtime enforcement director at the Securities and Exchange

Commission, has now prompted criminal and civil probes by the

Justice Department and the SEC."

-

From Accusations

of Accounting Mae-hem, Washington Post, Sunday, October

3, 2004; Page F02

Do recent actions by the Bush Administration regarding Fannie Mae

relate to the current Presidential election and the role of the

mortgage and homebuilding industry to campaign fund raising and

manipulation of the mortgage markets? When viewed through the lens

of "economic

warfare,"

does the recent agreement negotiated between OFHEO and Fannie Mae

give Republican interests extraordinary powers to micromanage Fannie

Mae and members of the mortgage banking industry for political purposes?

Open Secrets website

An online Guide

to the Money in US Elections

Why Fannie

Mae's Boss Wants John Kerry to Win

by John Crudele, NY Post, October 5, 2004

<-

Return to Table of Contents

Question

#6: Is Fannie

Mae vulnerable to class action lawsuits?

See:

Shareholder

Class Action Filed Against Fannie Mae by the Law Firm of Schiffrin

& Barroway, LLP

Press Release:

Schiffrin & Barroway, LLP

Thursday September 23, BALA CYNWYD, Pa

Additional Links

Office of Federal Housing Enterprise

Oversight (OFHEO) - homepage

Fannie Mae - homepage

Agreement

between OFHEO and Fannie Mae, September 27, 2004

Press

Archive on Sporkin, Sporkin's Role at Fannie Mae and Fraud

A compilation of articles and links related to Sporkin, his role

re: Fannie Mae, and fraud

Fannie

Mae – Annual Report &

Stock Proxy

Fannie

Mae – Stock History

<- Return to Table of Contents

|

|

As US Federal District Judge - District of Columbia

Question

#1: Why did you

lead the persecution of Hamilton Securities?

| You were for many years the

presiding judge on the Ervin

Qui Tam case – a case brought by Ervin, a Ginnie

Mae contractor, against Hamilton Securities, the leading firm

in Washington in helping to reengineer defaulted mortgages

– having designed and led HUD's successful $10 billion

mortgage auction program. Why did you extend the seal almost

four years, without evidence of any wrong doing, and despite

an FBI investigation report and HUD IG audit report finding

that there was no evidence of wrong doing? Why did you permit

the government to argue contradictory positions: arguing one

position in the Bivens case brought by Ervin in open court;

and a contradictory position in the Qui Tam case behind the

seal? Why did you coach Ervin's attorneys from the bench behind

the protection of the seal? Why are critical transcripts of

the sealed hearings missing from the records?

|

| |

|

The

only

mortgage-backed

security that

enjoys the full

faith and credit of the United States

Government

|

|

|

Links – HAMILTON SECURITIES Litigation

Where is the Money?

Litigation website

Documentation on the Hamilton Securities Litigation

Fitts

Fights Back, by Michael Ruppert, From the Wilderness

Where

is the Collateral?

by Chris Sanders, October 2003

So,

Where is the Collateral?

by Chris Sanders for Scoop Media, July 2004

On

the Money Trail -- The Dangerous World of Catherine Austin Fitts,

by Mari Kane for MetroActive, September 2002

Former

Bush Assistant Secretary for HUD Reveals "Ethnic Cleansing" Connected

to CIA Drug Dealing in Los Angeles:

Government Spends Millions in Campaign to Silence Former Wall

Street Banker, Cover Up Connections to Dark Alliance Stories &

CIA Inspector General Report on Drug Trafficking,

Catherine Austin Fitts, From the Wilderness, May 1999

Uri Dowbenko's "Catherine Austin Fitts: Enemy of the

State" Series:

HUD Fraud, Spooks and the Slumlords of Harvard

http://www.conspiracydigest.com/bushwhacked.html

DOJ Lies

http://www.conspiracydigest.com/dojlies.html

Redefining the Killer App: AntiTrust and the Real World

http://www.conspiracyplanet.com/review.cfm?rtype=14&reviewid=19&page=1

<-

Return to Table of Contents

Question

#2: What role

have you played in black budget market manipulation and $59 billion

missing from HUD?

As

a federal judge overseeing the seizure of the Hamilton Securities

computer files and software tools, including "Community Wizard"

and extending a four year seal on a qui tam lawsuit targeting, you

have played an instrumental role in destroying the regulatory financial

controls in the 1990's that could have prevented much of the US

mortgage market bubble and manipulations. How do you reconcile your

role in creating the US mortgage bubble with your role in helping

to bring "financial

responsibility" to Fannie Mae? As

a federal judge overseeing the seizure of the Hamilton Securities

computer files and software tools, including "Community Wizard"

and extending a four year seal on a qui tam lawsuit targeting, you

have played an instrumental role in destroying the regulatory financial

controls in the 1990's that could have prevented much of the US

mortgage market bubble and manipulations. How do you reconcile your

role in creating the US mortgage bubble with your role in helping

to bring "financial

responsibility" to Fannie Mae?

The persecution of Hamilton Securities and a series of HUD government

officials caused a significant drain in critical leadership at HUD.

Subsequently, HUD was not able to produce audited financial statements

and reported significant undocumentable adjustments, including $17

billion in 1998 and $59 billion in 1999, along with significant

increases in mortgage insurance. How would you describe your judicial

role in contributing to this explosion of federal mortgage liability

and implosion of federal mortgage financial and regulatory controls?

Franklin Raines, the CEO of Fannie Mae, was the head of the Office

of Management and Budget when these monies went missing from HUD.

What was his role?

How would you describe HUD's traditional performance in preventing

money laundering in the US mortgage and homebuilding markets?

The

Missing Money – links to key articles and government

documents on the missing trillions

Report

from Money Laundering Alert's 5th International Money Laundering

Conference

Fontainbleu Hotel, Miami Beach, Florida

by Catherine Austin Fitts, April 07, 2000

<-

Return to Table of Contents

Question

#3: Why did you

resign from the bench?

You resigned at the same time that Hamilton's legal documents along

with an overview of your management of the Hamilton qui tam and

other litigation was launched on the Internet. Also at that time,

your role in the alleged falsification of an affadavit related to

the conviction of Edwin Paul Wilson attracted media attention (see

Ed

Wilson's Revenge, FTW 1/00). (This was well before October 2003,

when Wilson's conviction was vacated and the Department of Justice

announced an investigation into the matter. What if anything, did

the Hamilton litigation, and litigation related to the Wilson conviction,

have to do with your resignation from the bench?

Links – HAMILTON SECURITIES Litigation

- See Links

under Question #1

Links – WILSON Litigation

<-

Return to Table of Contents

|

|

As General Counsel for the CIA

You

are the former General Counsel of the CIA and former head of the

Securities and Exchange Enforcement Division, both under William

Casey. You

are the former General Counsel of the CIA and former head of the

Securities and Exchange Enforcement Division, both under William

Casey.

Question

#1: Did you draft

the DOJ-CIA Iran-Contra Memorandum of Understanding?

You were the CIA General Counsel during the Iran Contra period,

including at the time that the CIA entered into the now infamous

Memorandum of Understanding

with the Department of Justice that permitted the CIA to

not report narcotics

trafficking by CIA assets.

This Memorandum

of Understanding between the CIA and DOJ was published as

part of the declassified two volume report by the CIA Inspector

General confirming the Dark

Alliance" allegations regarding CIA complicit narcotics

trafficking into South Central Los Angeles.

Crack

the CIA Cocaine,

On Line Video by Guerrilla News Network, Winner Sundance Film

Festival

<-

Return to Table of Contents

Question

#2: Why did you

suppress Community Wizard?

In

early March 1998, in your capacity as US

Federal District Judge, you approved the court takeover of

Hamilton Securities office, during which Hamilton's

software tools and databases – including their Community Wizard

system – were destroyed and/or seized by the court, and related

decisions by you ensured that the Department of Justice was able

to seize monies owed to Hamilton. The databases, destroyed or removed

from the Internet until many years later, included the maps of high

defaults on HUD mortgages in areas targeted by alleged CIA narcotics

trafficking, including South Central LA. In

early March 1998, in your capacity as US

Federal District Judge, you approved the court takeover of

Hamilton Securities office, during which Hamilton's

software tools and databases – including their Community Wizard

system – were destroyed and/or seized by the court, and related

decisions by you ensured that the Department of Justice was able

to seize monies owed to Hamilton. The databases, destroyed or removed

from the Internet until many years later, included the maps of high

defaults on HUD mortgages in areas targeted by alleged CIA narcotics

trafficking, including South Central LA.

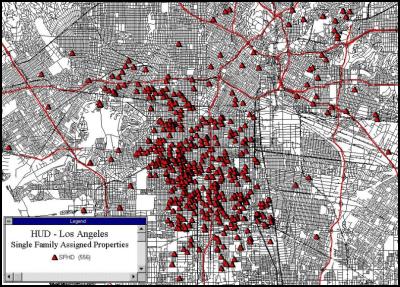

For example, the

following map

was generated using Community Wizard,

a software system providing communities with important financial

information about their place:

South Central Los Angeles

Narco-HUD connection?

(click for larger image

& narration)

Place-Based Survey Material, prepared by Hamilton Securities

Group

http://www.dunwalke.com/gideon/legal/background/DesidnBk/place.htm

including

Maps showing high

concentrations of mortgage defaults prepared for Hamilton

by Edgewood Technology Services

Loan Sale Design Book, prepared by Hamilton Securities

Group

http://www.dunwalke.com/gideon/legal/background/DesidnBk/Home.htm

The patterns shown in these maps demonstrate the characteristics

of HUD fraud described in recent Soprano TV shows.

In Tony Soprano's mob world,

HUD exists to facilitate embezzlement,

theft, and extortion... fiction, or reality TV?

While Hamilton was locked out of its offices and was overwhelmed

by managing the workload related to an effort by government investigators

to falsify "evidence"

while controlling and trashing Hamilton's

offices and systems, in hearings on Volume

1 on March 15th, 1998, CIA Inspector General Hitz disclosed

the existence of this secret Memorandum of Understanding between

the Bill Casey as CIA Director and then Reagan Attorney General

William French-Smith. On October 8th, 1998, the declassified version

of Volume

II was made public one hour after the House of

Representatives voted to conduct an impeachment inquiry on President

Clinton and just before House members were compelled to cease all

other activity to resolve the budget crisis. Subsequently, several

people involved in the negotiations died unexpectedly (reference

Snider

Quits, paragraph 5).

The narcotics trafficking

by CIA during the time in which you were CIA General Counsel

were further illuminated by the depositions of Tom and Desiree Ferdinand,

son-in-law and daughter of Col. Al Carone, formerly of the CIA,

Army and NYPD, filed that year in a lawsuit against the CIA that

were maintained under seal until the late 1990's. (D'Ferdinand deposition

by attorney Ray Kohlman - Part I, Part II, Part III, Part IV, Part

V; Tom Ferdinand deposition by attorney Ray Kohlman

- Part I, Part II, Part III.)

Tony

Soprano HUD Fraud and Map of South Central Los Angeles HUD Defaults

America's

Black Budget & Manipulation Of Markets

Jim Puplava interviews Catherine Austin Fitts, 18 May 2004

on Financial Sense Radio - Transcript

/ Real

Audio / MP3

The

Negative Return on Investment Economy – a Discourse on America's

Black Budget

by Chris Sanders and Catherine Austin Fitts, June 2004

<-

Return to Table of Contents

Question

#3: What was your

role with the Mena, Arkansas Iran Contra operation and local HUD

agency?

The Sporkin years at the CIA were also illuminated by numerous

reports of arms and narcotics trafficking in Mena, Arkansas during

Iran Contra and related money laundering through the state housing

agency, the Arkansas Development Finance Agency. During this period,

Vice President George H. W. Bush was in charge of all US enforcement

and intelligence operations through the National Security Council,

Oliver North was at the NSC and President Bill Clinton was the Governor

of Arkansas, and Senator Hillary Clinton was a partner in a law

firm that served Arkansas Development Finance Authority, alleged

to have laundered the state share of the profits.

Hostages,

by Mike Ruppert

The

Crimes of Mena, by Sally Denton & Roger Morris, 7/95

The Boys on the Track,

various articles by Mara Leveritt

Gray

Money, by Mark Swaney, 1995

Murder,

Mayhem and Mystery in Mena, Preston Peet,

The

Mystery of the "Lost" Mena Report

Gray Money: the Continued Cover-Up,

by Mark Swaney, The Sierra Times, July 26, 2001

What

Really Happened, Mena Archives:

The Clinton Scandals

(see Mena sections), Sam Smith's Progressive Review

Narco News Bulletin

- Reporting on the Drug War

Al Giordano, Publisher

<-

Return to Table of Contents

Question

#4: Is "Slimey

Affirm" a code name you used in an off shore account?

In his book Defrauding

America, Rodney Stich describes allegations regarding your

code name, "Slimey Affirm," for off shore accounts maintaind

in connection with Nugen Hand Bank. What has been your practice

of maintaining off shore accounts throughout your government and

judicial career?

Defrauding

America - Forty-Five Years of Drug Trafficking,

Book by Rodney Stich

Drugging

America - A Trojan Horse,

Book by Rodney Stich

Press

Archive on Sporkin

Articles and links re:

Sporkin's Role at Fannie Mae and Fraud,

Including Soprano HUD Fraud and Stitch money laundering allegations

<-

Return to Table of Contents

The Hamilton Securities

maps of South Central LA were made by a start-up data servicing

company in a low income residential Washington, DC community --

Edgewood Technology Services. Was the bipartisan rejection of Hamilton

and Edgewood, and Catherine Austin Fitts' model of building community

databanks (such as Community Wizard) and venture capital related

to government dependence on narcotics trafficking and money laundering?

The

Story of Edgewood Technology Services or How I Lost $100Million

Discovering Who Makes Money Making Sure the Solari Index Does

Not Go Up

(Parts I-III) Summer 1999, Republished 2002

<-

Return to Table of Contents

|

|

As Director of the SEC Enforcement Division

Question

#1: Are US enforcement

efforts designed to prevent or promote money laundering?

During your rise to prominence, the US leadership of global money

laundering has grown to an estimated $500 billion - $1 trillion

a year. Would you say that US enforcement efforts are designed to

prevent or promote "dirty money" flows?

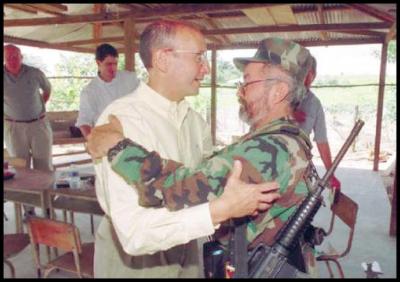

Richard Grasso, former Chairman of the NY Stock

Exchange,

greeting a Colombian FARC commander

Narco

Dollars for Beginners

Catherine Austin Fitts, October 2001 (in 13 Sections)

RJR

Takeover Wars—The Next Episode,

Catherine Austin Fitts, November 2002

The European Union Sues RJR Tobacco for Two Decades of Global

Money Laundering for Colombian Drug Lords, Russian Mafia, Italian

Mafia, Saddam Hussein's Family & New York Real Estate Investors

<-

Return to Table of Contents

Question

#2: Is National

Security Law used to fraudulently over-issue mortgage securities

to fund the "black budget"?

What are the criminal and civil violations involved if a government

agency, private corporation and or state housing agency were to

over-issue mortgage backed securities or housing bonds reflecting

more in financial capital than existed in actual mortgages or homes?

Could such violations be overridden by the National Security Act

of 1947 and the CIA Act of 1949, which make special provisions for

unusual financing arrangements to

fund the black budget?

America's

Black Budget & Manipulation Of Markets

Jim Puplava interviews Catherine Austin Fitts, 18 May 2004

on Financial Sense Radio - Transcript

/ Real

Audio / MP3

The

Negative Return on Investment Economy – a Discourse on America's

Black Budget,

by Chris Sanders and Catherine Austin Fitts, June 2004

<-

Return to Table of Contents

|

|

Additional Background

Information

Judge Sporkin joined Weil,

Gotshal & Manges as a partner. Weil

Gotshal is considered one of the leading bankruptcy law firms in

the US. Weil Gotshal is the lead bankruptcy counsel to Enron, whose

financial managers have been indicted for money laundering.

Weil

Gotshal's website and "Who's Who in America" provide the following

information.

|

![]() |

![]() |

| Contact Information

Washington D.C. Office

(202) 682-7146

1615 L Street, NW

Suite 700

Washington, DC 20036-5608

stanley.sporkin@weil.com

Trade Practices and Regulatory

Law Department

Practice Areas

![]() Trade Practices and Regulatory Law

Trade Practices and Regulatory Law

![]() Corporate Governance

Corporate Governance

Education

Yale University Law School (JD 1957)

|

|

Biographical Information

Judge Stanley Sporkin (Ret.) is a Partner at Weil, Gotshal

& Manges residing in its Washington, D.C. office. Judge

Sporkin's practice consists of counseling parties in SEC,

Corporate Governance and Litigation Matters. Because of

his judicial background, he also acts as an arbitrator and

provides mediation services.

Judge Stanley Sporkin was born in Philadelphia

in 1932, attended Pennsylvania State University from 1949-1953

and received his law degree from Yale University in 1957.

Bar: Del, 1958, Pa. 1958, U.S. Dist. Ct.

DC 1963, US Supreme Ct. 1964, US Cot Appeals (2nd

cir.) 1975, U.S. Ct. Appeals (4th cir.) 1978.

Law clerk to presiding justice U.S. District

Court, Del., 1957-60 then twenty years with the SEC serving

the last seven as the Director of the Division of Enforcement:

1960-61 staff atty, spl. study securities markets U. S.

Securities & Exchange Commission, 1961-63, atty., 1963,

chief atty. Enforcement branch, 1963-66, chief enforcement

attorney, 1966, ast. Dir., 1967, assoc. dir., 1968-72, Deputy

Director - Trading and Markets, 1972-73, Director Enforcement

Division, 1973-81.

He then went to the CIA from 1981-86 where

he as the General Counsel. In 1985, President Ronald Reagan

appointed him to the Federal Bench where he served as a

United States District Judge for the District of Columbia

for 14 years. Judge Sporkin is also a Certified Public Accountant.

In 1976 he received the National Civil Service League's

Special Achievement Award and in 1978, Judge Sporkin received

the Rockefeller Award for Public Service from the Woodrow

Wilson School of Public and International Affairs at Princeton

University. In 1979, he was the recipient of the President's

Award for Distinguished Federal Civilian Service, the highest

honor that can be granted to a member of the Federal career

service. During his service with the Central Intelligence

Agency, the Director of Central Intelligence conferred on

him the Distinguished Intelligence Medal. In 1990, he was

named an Alumni Fellow at the College of Business Administration,

The Pennsylvania State University. In 1994, he was presented

the William O. Douglas Award for Lifetime Achievement by

the Association of Securities and Exchange Commission Alumni

and honored by B'nai B'rith and in May 1996, he was presented

the H. Carl Moultrie Award for Judicial Excellence by the

Trial Lawyers of Washington, D.C. In June 2000, he was presented

with the prestigious Federal Bar Association's Tom C. Clark

Award. In October 2000, Judge Sporkin received the Judicial

Excellence Award from Judicial Watch

Judge Sporkin is the son of The Honorable Maurice W. Sporkin

(deceased), a long time Judge of the Court of Common Pleas,

Philadelphia, Pennsylvania, and Ethel Sporkin (deceased).

He is married to Judith Sally Imber (married September 30,

1955) and has three children: Elizabeth Michael Sporkin,

Daniel Paul Sporkin, and Thomas Abraham Sporkin; and two

grandchildren.

Judge Sporkin has served as an adjunct

professor at Antioch Law School, 1974-81, Howard University,

1971-, member of the executive committee, University of

California Securities Regulation Institute, 1977-

- Fellow, American Bar Found.

- Member, American Bar Association

- Federal Bar Association (exec. Council securities law

sect. 1978-)

- Delaware Bar Association

- Bar Association of DC

- American Law Institute

- American Institute of CPAs

- Federal Legal Council

- Administrative Conference of the US

- Phi Beta Kappa

- Phi Kappa Phi

From an internet search:

Board of Advisors, Wall Street Management

& Capital Inc.

|

|

|

Related

Books

- Black Money, Michael Thomas, Crown (HC) / St Martins (paper),

1994/95 (*)

- The Boys on the Tracks,

Mara Leveritt. St. Martin's Press, 1999

See also the book

reviews

- Cocaine Politics: Drugs, Armies, and the CIA in Central America,

Peter Dale Scott & Jonathan Marshall. Berkeley: University

of California Press, 1998.

- The Collected Works of Col. L. Fletcher Prouty, including, The

Secret Team: The CIA and Its Allies in Control of the United States

and the World, Col. L. Fletcher Prouty (Ret.) and Understanding

Special Operations And Their Impact on The Vietnam War Era - 1989

Interview with L. Fletcher Prouty Colonel USAF (Retired), by David

Ratcliffe, rat haus reality press, 1999. http://www.ratical.org/ratville/JFK/ST/

http://www.ratical.org/ratville/JFK/USO/

CD-Rom, available from http://www.prouty.org/cdrom.html at The

Col. L. Fletcher Prouty Reference Site

- Dark Alliance, Gary Webb. New York: St. Martin's Press, 1998.(*)

- Dope, Inc.: Britain's Opium War Against the United States, Konstandinos

Kalimtgis, 1978

- False Profits: The Inside Story of BCCI, the World's Most Corrupt

Financial Empire, Peter Truell & Larry Gurwin. Boston: Houghton

Mifflin Company, 1992.

- Hot Money and the Politics of Debt, R. T. Naylor. Montreal:

Black Rose Books, 1994.(*)

- The Mafia, CIA and George Bush, Pete Brewton. New York: S.P.I.,

1992. Introduction: http://www.freerepublic.com/forum/a389b6a173e33.htm

- Opium, Empire and the Global Political Economy, Carl A Trocki.

Routledge: Taylor & Francis Group, 1999.(*)

- The Politics of Heroin: CIA Complicity in the Global Drug Trade,

Alfred W. McCoy Lawrence Hill Books, 1991.

- Powderburns: Cocaine, Contras and the Drug War, Celerino Castillo,

Dave Harmon, Mosaic Press, 1994

- WhiteOut: The CIA, Drugs, and the Press, Alexander Cockburn

and Jeffrey St. Clair. Verso, London:1998

|

|

|